Here at Select Insurance, we promise to keep you informed as things in the industry change or the policy changes. We believe it is wise for you to know how the insurance policy works in order to have reasonable expectations if or when a claim needs to be filed.

This important message incorporates changes coming soon specific to the Grange Insurance Home Policy and the homeowner insurance market as a whole.

Starting January 1, 2024, the Grange Insurance Home Policy will have the following changes:

- The home policy deductible will increase to $2,500, $5,000, or $10,000, depending on the Coverage A amount. Homes over 1 million would have the $10,000 deductible. Check your renewal declaration page to see the new deductible; this is for all perils EXCEPT Wind or Hail claims.

- A Wind/Hail deductible will be 1% of the Coverage A limit. The Wind/Hail deductible will be shown on the renewal declaration page. 1% of the dwelling amount adds up, this is why we are recommending to lower this to match the ‘other-peril’ deductible.

- Actual Cost Value – Depreciation will be calculated when a claim is from wind/hail. For example, if the damage is to the roof and the damaged roof was a 30 year shingle, the depreciation will be calculated at a rate of 3.33% per year. The insurance carriers have a depreciation schedule depending on the type of material damaged.

- A six-month window to report a wind/hail claim is in the policy. This was added several years ago to discourage the contractors’ practice of using the homeowner’s policy to pay for a roof.

We recommend the 1% wind/hail deductible be reduced to match the all other peril deductible. For an upcharge, we will make that change so you can avoid the 1% deductible. Example: if your Coverage A is $400,000, the 1% Wind/Hail deductible would be $4,000 and each time the policy renews the dwelling coverage increases and so will the Wind/Hail deductible. By paying a little more, the deductible will be reduced to a set amount of $2,500. This is even more important when the roof is over 15 years old since there will be depreciation taken for the roof in addition to the deductible.

Pat Lamb

The uptick in claims is being felt industry wide:

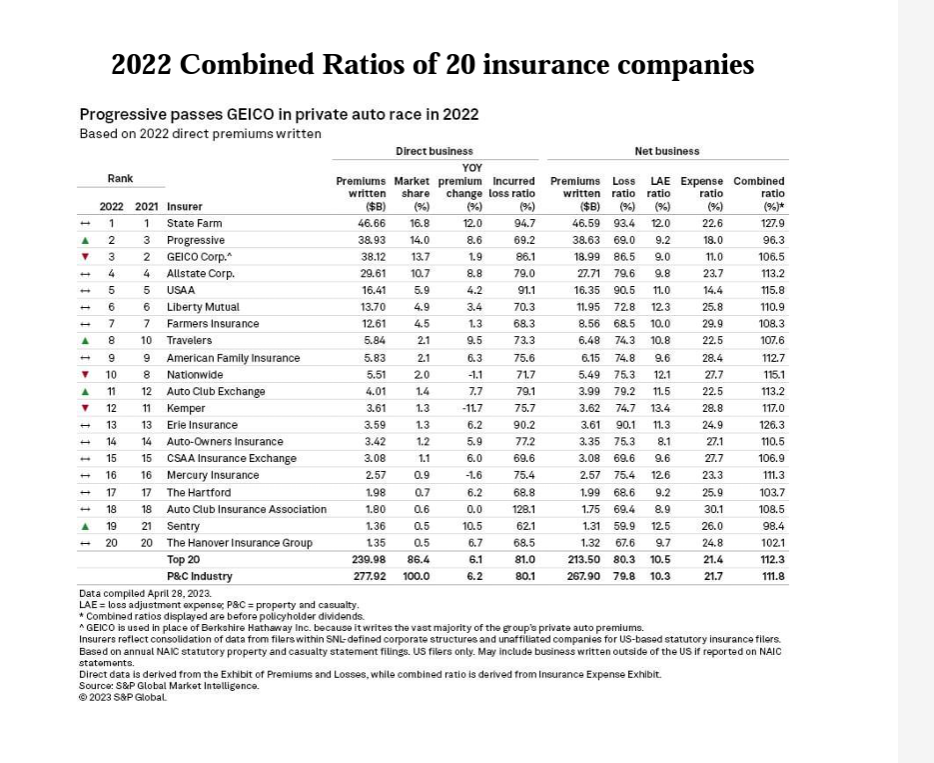

Most carriers are reporting that they have paid more in claims than they take in through premiums. We’ve read reports that insurance carriers are paying out over $1.50 for every dollar taken in premium. Clearly this is a trend that can’t continue. In the short-term, the insurance companies use their reserves during these times, however this is watched closely by the Department of Insurance and credit rating agencies like AM Best who evaluates an insurance company’s financial stability.

This year was the first time in our career, that we experienced an insurance company closing its’ doors. Mutual Aid Exchange (MAX) was closed down by the Department of Kansas and forced into liquidation. Our agency was given no warning other than an email to tell us they were closed. We immediately found our MAX clients a replacement policy. We can’t even imagine what would have happened if a claim occurred before we found a replacement policy.

Click here for a list of the insurance-rating services. Below are last year’s results. We know the 2023 storms impacted this year’s loss-ratio even more. Most carriers are running a combined loss ratio (claims and expenses) over 100% – meaning carriers are paying out more money than they take in premiums.

Trust is what we place in the insurance company to pay claims especially those claims that could devastate our financial security. Let’s face it – not all claims will rock our world. All claims are an inconvenience and they never happen at a good time (Murphy’s Law). However, when it is a major claim, we need to be able to rely on the insurance policy for all its’ worth. This is why a carrier with a strong financial rating who pays claims responsibly is important.

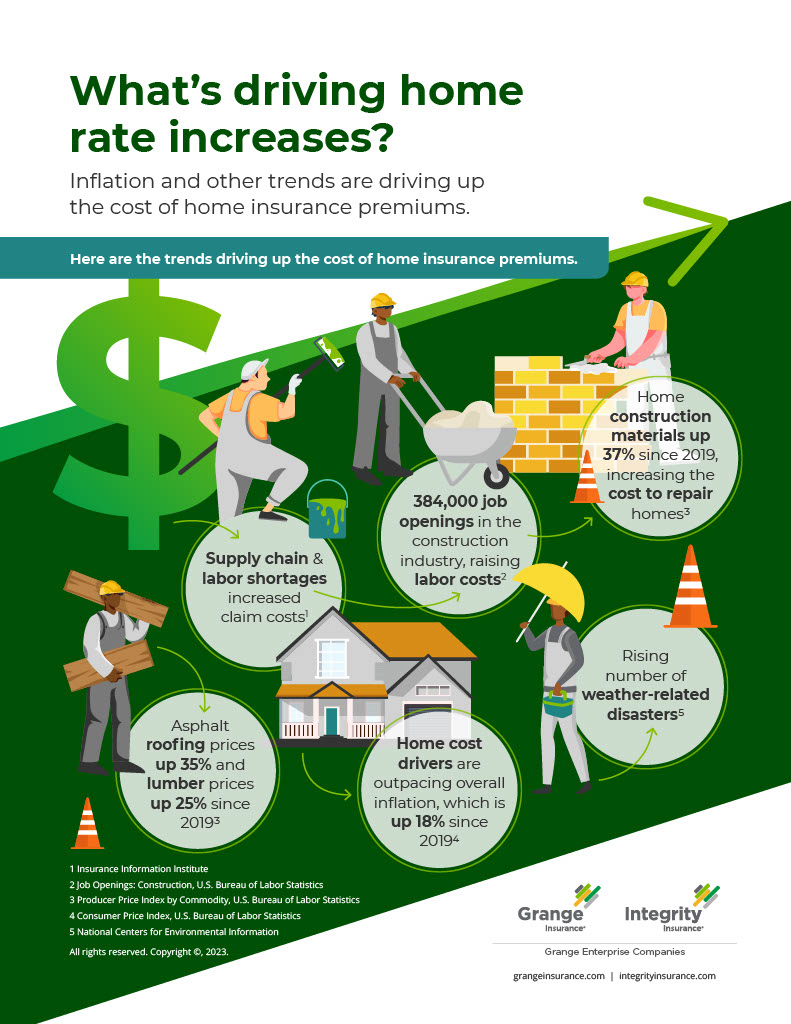

What is the “Perfect Storm” causing the disruption in the marketplace? Murphy’s Law at work here too. “Anything that can go wrong will go wrong”, and it has.

The weather pattern changes in Ohio have increased storm activity. Claims by wind and hail have been on the rise in areas that were not prone in the past. Insurance companies are tracking the areas by zip code and considering using this data to price the homeowner product. Rating by zip code for Water Backup coverage is done currently by most carriers.

Inflation is driving up the cost of goods and services. The industry pays for the goods and services needed to repair homes and cars. These costs have increased as much as 40%, which is substantial.

Re-insurance costs have increased. Insurance companies buy insurance to spread out the risks too. They purchase a layer of protection that helps their financial resources. The cost of re-insurance has risen to levels they haven’t experienced. Along with higher deductibles, this means they need a stronger financial portfolio to cover more risk.

Finally, investment income is not performing to offset the claim shortage. Insurance relies on investment income to help cover the fluctuation in claims costs and other insurance expenses.

Recap of the home insurance changes on the horizon:

Rate increases: Until the industry stabilizes, increases will continue. However, it is understood that prices alone won’t resolve the issue.

Deductible increases: The standard deductible is outdated. An increase in the policy deductible is a strategy that reflects how much more things cost today. For years, the standard home deductible has been $1,000. However, due to inflation, repairs that once cost $1,000 costs three times that amount or $3,000.

A percentage deductible: The peril being paid out most often is for wind and hail claims. A separate deductible that is specific to wind/hail claims is something the industry is implementing. Based on the policy’s dwelling limit, this would be a 1% deductible. If your home is insured for $400,000, the 1% wind/hail deductible would be $4,000. We recommend buying down the 1% wind/hail deductible to match the all peril deductible shown on the policy. It is worth the extra cost to avoid having such a high deductible for wind/hail claims.

Replacement cost settlement versus Actual Cash Value settlement (ACV): Most wind/hail claims reported are roof claims. Using roof claims as an example, the life of an average roof is 30 years. When the roof is replaced, the existing shingle material may not be as strong as it was when it was installed. The industry has already changed the settlement option for roofs over 15 years old to Actual Cash Value, which means the cost of the repair or replacement is depreciated based on the roof’s age. This is the language currently in your policy. There will be a deduction from the claim settlement for depreciation AND the policy deductible. The deductible could be significant if the policy has the 1% deductible.

What am I paying for? And why do my rates keep going up?

Insurance companies combine all premium dollars collected by all the policyholders to pay claims. Insurance companies rely on premium payments to pay claims. Paying an insurance premium protects against many unforeseen events such as fire, windstorm, explosion, vandalism, theft, and much more. It also includes coverage for personal belongings and additional cost of living to help offset expenses while the home is being rebuilt. Plus, under the liability section of the policy, it protects if injuries occur or property is damaged to others accidently.

Check out this reference guide offered by the Department of Insurance on what is and is not covered.

A proactive approach to stabilize the cost of the homeowner product. Grange is one of the carriers reacting in a way that will keep rates as stable as possible by having the policyholder when they have a claim pay more, so those who don’t have a claim aren’t as affected.

Insurance carriers will use higher deductibles and depreciation to help reduce the need for higher price hikes.

If the industry kept the deductibles low and did not add a depreciation clause for wind/hail claims, the insurance premiums would be substantially higher for everyone. So, the question is – should everyone pay substantially more in premiums each and every year when a large percentage of people never have a claim? Or, is it more reasonable to keep the premiums as low as possible and only those that have a claim will be asked to pay more through a deductible and depreciation (when applicable). Most companies are leaning toward stabilizing the pricing by having those who make the claim participate more.

The insurance companies are tasked with being good stewards of the clients’ money by paying claims fairly and responsibly.

Most people do not have enough money to pay a catastrophic claim. A total loss claim would devastate even the best saver. Paying a premium, compared to the hundreds of thousands of dollars the policy could pay in a total loss claim, gives both peace of mind and financial security to the homeowner. This is the foundation of insurance, and in our opinion, the number one defense against the unexpected.

Pat Lamb

Setting the claim expectation:

Planned preparedness, having a solid emergency fund, and understanding what the policy will cover are the tools needed for a good claims experience. By knowing the policy will help pay for storm damage with additional monies coming from the homeowner to cover the deductible and depreciation (if applicable) will make for a well-informed homeowner. Sorry to say there is no magic wand to make the incident disappear. It’s one of those life events that need to be worked through.

The homeowner should vet the contractor and get more than one bid like any other remodel project. The insurance policy will help pay, however the homeowner is signing the contract with the contractor so make sure they are reputable.

The homeowner will be required to use the claim payment to repair the damaged area. The repairs are required once the claim payment is made by the insurance company; scheduled the contractor right away. The insurance company will ask for proof of the repair by showing a receipt.

I often say that the insurance company helps fund the project covered by the policy. The insurance company is not the contractor or project manager. When framed this way, it helps the homeowner realize that the event that happened (even though not planned), should be handled like any other home project. The homeowner get estimates, vet the contractor and hire the best contractor for the job.

Pat Lamb

Why are roof claims such a hot topic?

There are a few reasons this is a hot topic. 1) Most home claims come from wind and hail storms and these type of storms continue to increase in Ohio. 2) The shingles on our homes are made of materials that just don’t last like they once did. 3) Contractors are knocking on doors looking for business and what better way to get the homeowner’s attention than to suggest that there could be storm damage on their roof.

We see the reaction when people turn in a roof claim; they expect a new roof, losing sight that the roof is something they would have had to replace due to age. Even though the storm was an incident that shortened the roof’s life, replacing it is expected and inevitable. This is a different situation than a house fire or a tornado wiping out a home or a neighborhood, causing unexpected repairs.

There have been so many storms over the past several years that it may have sent a message to homeowners that if they wait long enough for the next storm, eventually, the insurance policy will pay for their roof replacement. The roof surface is like any other product in the home; it will eventually wear out and need to be replaced. To wait until the roof leaks, causing interior damage, or waiting until the age of the roof exceeds its’ life is not a plan that will guarantee the homeowner a new roof by way of the insurance policy.

It shouldn’t matter who pays for the roof replacement or the roof repair. Over the years, many contractors have found ways to get paid more than they would be paid if working directly with the homeowner. Consequently, this adds to the problem because more money is being paid for repairs which costs us all in the end. The roofing contractor should not have two sets of prices depending on who pays.

Roofing Marketplace. A new company has formed to help insurance companies stop the overinflated prices passed on to the insurance company and to help the homeowner know what is a fair cost to do the work. How it works, is a network of master roofers will bid the job by agreeing to price the job with ‘market prices’ not an inflated price just because insurance is paying. The homeowner can choose to use that roofer who offered the bid or find their own roofer. The network of roofers in the Roofing Marketplace is a proactive way to curtail the unfair roofing practices and weed out the reputable contractors from the storm chasers.

The insurance policy will pay for the direct physical damage caused by wind or hail. The policy does not pay for a full roof replacement unless the damage is severe enough to warrant it. The roofing contractor may assert that the shingles can’t be matched, which is likely true. However, that doesn’t mean the policy will pay to match the shingles. As the homeowner, you are welcome to pay the extra cost to replace the section of roof not included in the claim to accomplish a full roof replacement.

When the policy is written with an ACV or depreciation clause for wind/hail claims, the insurance company does not pay for matching shingles. Again, the homeowner is welcome to contribute additional funds to accomplish a complete roof replacement. The percentage taken for depreciation is 3.33 percent per year.

The adjuster will let you know how the coverage applies and what the settlement offer will be. Please remember that you will be sharing in the claim, especially if the age of the roof is at least 15 years old. That said, once the insurance company issues a check for the depreciated value, repairs must be made. The insurance company will not insure a home with damage as it makes it more vulnerable to damage the next time a storm comes through.

The roofing contractor may paint a different picture than what will happen when a claim is submitted. The roofing contractor would love to have the insurance company pay for everything – as an insurance company has deeper pockets than a homeowner. The contractor knows that most people do not have thousands of dollars to spend on an unplanned event, so they encourage the homeowner to file a claim against the policy. The contractor doesn’t explain the consequences of submitting a claim that won’t be covered or one in which only a partial claim payment would be made.

Signing a work order, agreement or contract with the roofing contractor. Don’t sign your rights away! Hold off signing any contracts until the claim adjuster works through the process with you so you know how the policy will respond and how much money you’ll be required to pay (deductible and depreciation) You’ll be able to vet the roofing contractor after the adjuster has the chance to explain the process the adjuster will be able to offer local roofers who could do the work as well if needed, but the choice is always yours.

Call us, for guidance before turning in a claim. When we are engaged in the claim process, we can advise the homeowner of the coverage for their specific situation. Knowing that information is key to making a good decision on how to proceed with submitting a claim. If a claim has already been turned in, check with the adjuster to review the specifics of your coverage before signing an agreement with the contractor. Did you know there is a law on the books regarding contractor scams? Check this out.

Get estimates to make sure you are getting a fair price for the roof. There is a good chance if you ask a roofer for an estimate letting them know you are paying it yourself, the estimate will be less.

A practical approach to roof damage is to consider taking the claim settlement as a payment toward the full roof replacement and fund the rest of the project yourself. This choice will ensure that the whole roof is done, that it matches, that replacing the other sections years later won’t be necessary, and that your roof coverage will be the best for the first 15 years of the home policy.

How to find a reputable roofing contractor:

Two popular roofing manufacturers are GAF and Certainteed. Check their website to find master roofers in your area to get a fair market price to repair or replace your roof.

GAF: https://www.gaf.com/en-us/roofing-contractors/residential (Silver Pledge status)

CERTAINTEED: https://www.certainteed.com/find-a-pro (SSM – Select Shingle Master)

© 2023 – Select Insurance Services Agency, Inc. – our opinion our POV