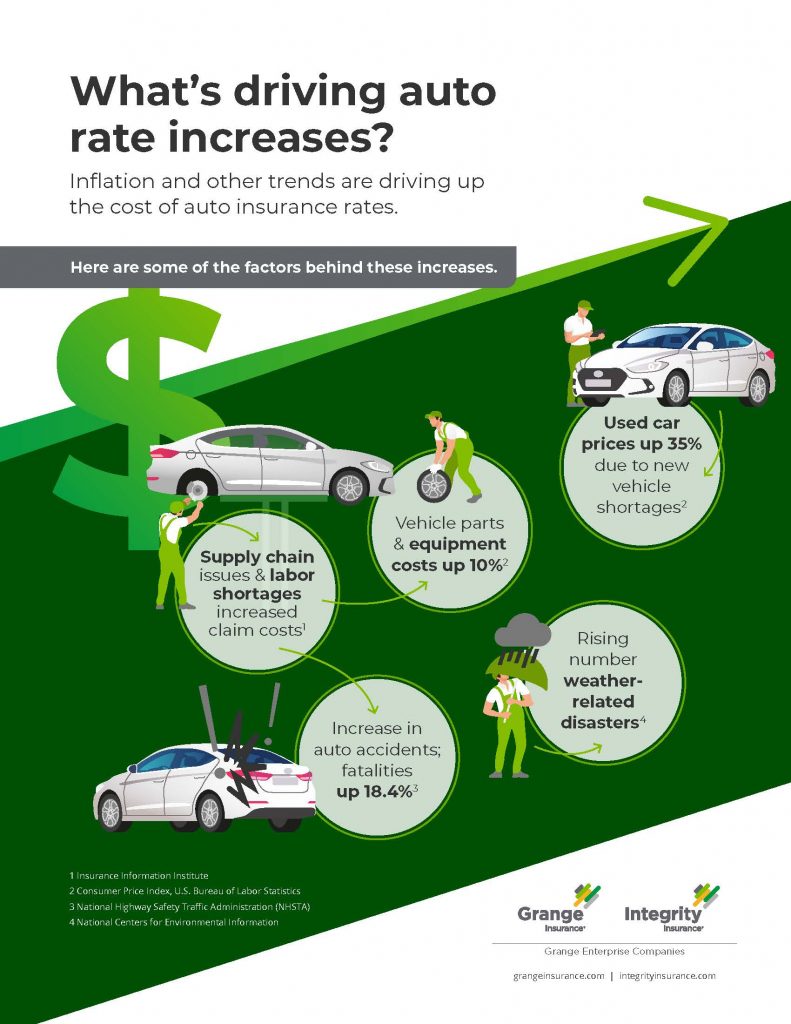

Why are rates going up? This infographic does a good job to show why insurance rates are going up. This also applies to home insurance for similar reasons. It is more expensive to buy materials to fix the home and contractors are more expensive because they are in demand.

Here is a little refresher on how insurance works: The insurance dollars we pay go into one pool to pay claims. The Insurance department requires the pool to have a certain amount of dollars in it at all times for catastrophic events and so the insurance company stays in business.

The folks at the insurance companies (actuaries) look at trends and crunch the numbers to determine what to charge to cover future claims activity, overhead and meet state regulations. We can only hope (and pray) that the weather in NE Ohio is kind as to not further cause stress to an already stressful supply and demand situation.

We all see the cost of goods and services rising and supplies dwindling and this adds up to the higher cost for everyone! There is no surprise here! At the end of the day, the insurance promise is to pay for injuries and to repair the damaged property covered by the policy, and for this money is needed.

Watch this video from Grange Insurance Financial Officer, Terri Brown as she explains how insurance is impacted.

AUTO RATES: Things to consider that could help lower or maintain insurance costs:

- Details that impact the cost: Let’s make sure the details for your policy is correct. Even something as small as the garaging address could impact the cost of insurance. Schedule a call for your policy review: selectinsservice.youcanbook.me

- What is your risk-tolerance? Maybe you are in a financial position to afford a higher deductible. The higher the deductible the lower the cost of insurance.

- Discounts: If we don’t have your home insurance written with the same insurance carrier, let’s look at this again. The cross discount may be a big help to keep cost down on both policies.

- Billing fees: If your invoice comes int he mail (paper), you are paying more unnecessarily. Let’s visit the savings to set the policy up on monthly auto-pay. This lowers the cost of insurance AND saves on monthly billing fees.

- More discounts... Most of the insurance companies we represent, offers a way to have your driving skills rewarded by using a mobile app to track your driving style. It’s best if all drivers on the policy agree to this and the discount can be as high as 15%.

- Violations and accidents: Keep your driving record as clear as possible. A simple speeding ticket can impact your auto rates by hundreds of dollars per year.

- Our insurance score which is not the same as a credit score is factored into the mix.

HOME RATES: Things to consider that could help lower or maintain insurance costs:

- Details that impact the cost: Just like in the auto policy, details matter. Things such as the age of the roof or security devices could impact the cost. Reevaluating the policy limits (dwelling coverage) and endorsements is not a bad idea at this time too. Maybe this exercise won’t save ‘premium dollars’, but it could save thousands of dollars of out-of-pocket if you had a claim and the amount of insurance was short to rebuild or repair the home. We will determine the right insurance-value when you schedule the policy review: Schedule your policy review: selectinsservice.youcanbook.me

- What is your risk-tolerance? Maybe you are in a financial position to afford a higher deductible. The higher the deductible the lower the cost of insurance.

- Discounts: If we don’t have your home and auto insurance written with the same insurance carrier, let’s look at this again. The cross discount may be a big help to keep cost down on both policies.

- Billing fees: If you pay the home policy and not your lender through the escrow account and the bill comes in the mail, there could be billing fees and charges that are avoidable. Consider paying the home insurance in-full for the year or let us set up the account on monthly auto pay.

- Prevention is best when it comes to insurance: Here are some handy weather for severe weather

Don’t be fooled! If you are offered a lower rate, most of the time something has been removed even if you think the coverages look the same (it takes a trained eye to see the differences). Insurance is a complicated product to purchase without a professional in your corner.

If you have been offered a quote that looks good, email it to us at staff@selectinsservice.com. We will give a second opinion objectively showing any coverage differences from what you have in your policy now so you are able to make an informed decision.

Two important considerations when shopping for insurance: 1). The cost of the coverage package presented 2) The service professional you buy from is someone you should like and relate to. The “agent” and their team, after all, is who you will interact with 95% of the time to answer your questions, provide advice, and make recommendations. So, choose someone knowledgeable who can explain things in terms you understand. Don’t tell them what you think you need in the way of coverage because they need to show you they know what they are doing and know how to put a plan together. Pay attention to their recommendations and the reason for the recommendation. Have they closed coverage gaps or are they creating coverage gaps? Bottom line, shopping isn’t all about the amount you pay for the policy if that policy isn’t providing what you need!

We care too much about you and your financial security. This is why we made a promise to be your insurance guide, advisor, and advocate not just a person who sold you a policy then forget about you. This is also why we represent more than one insurance company so we are able to offer options and choices.

Are you happy with our service? Have we met or exceeded your expectations by responding quickly to what you’ve asked and maybe went above and beyond. Then don’t leave all that, let’s compare to see if what you have now is a fair price so you can maintain the level of service you have come accustomed to.

Do you have the itch to shop? Let us know and we will do the work – it’s as easy as that!